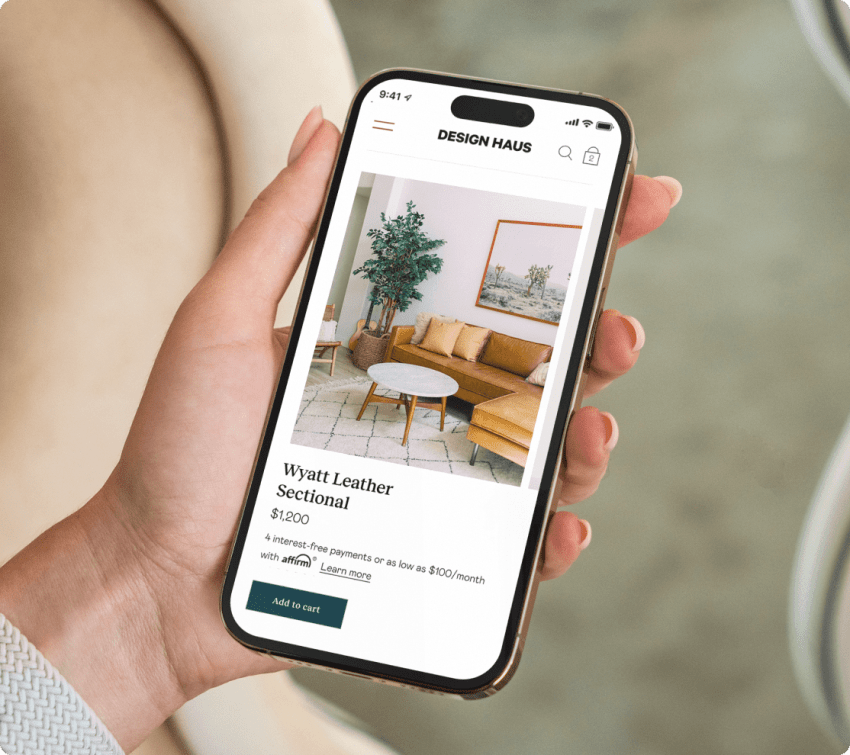

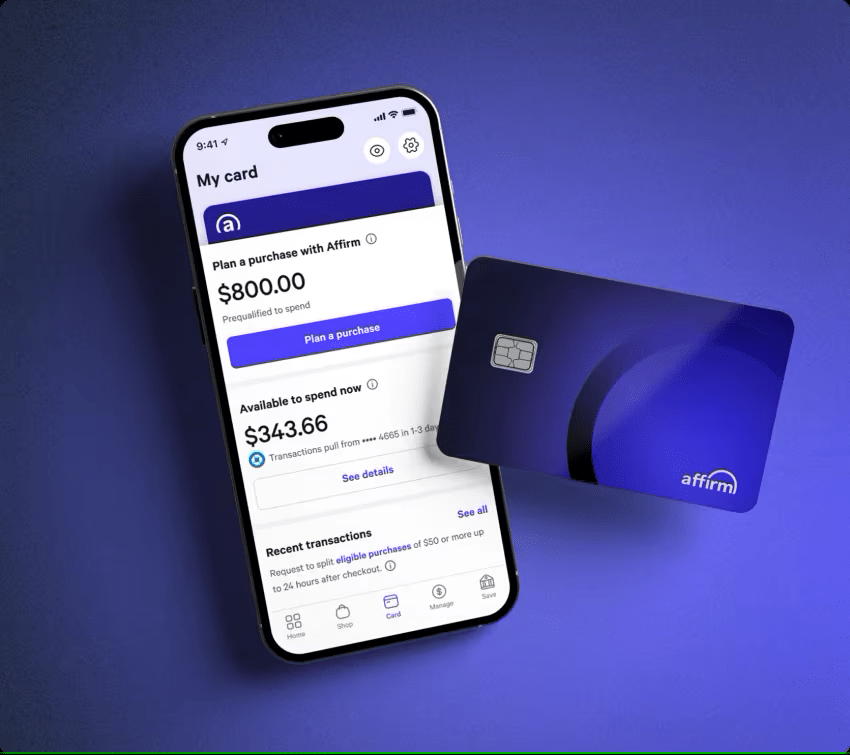

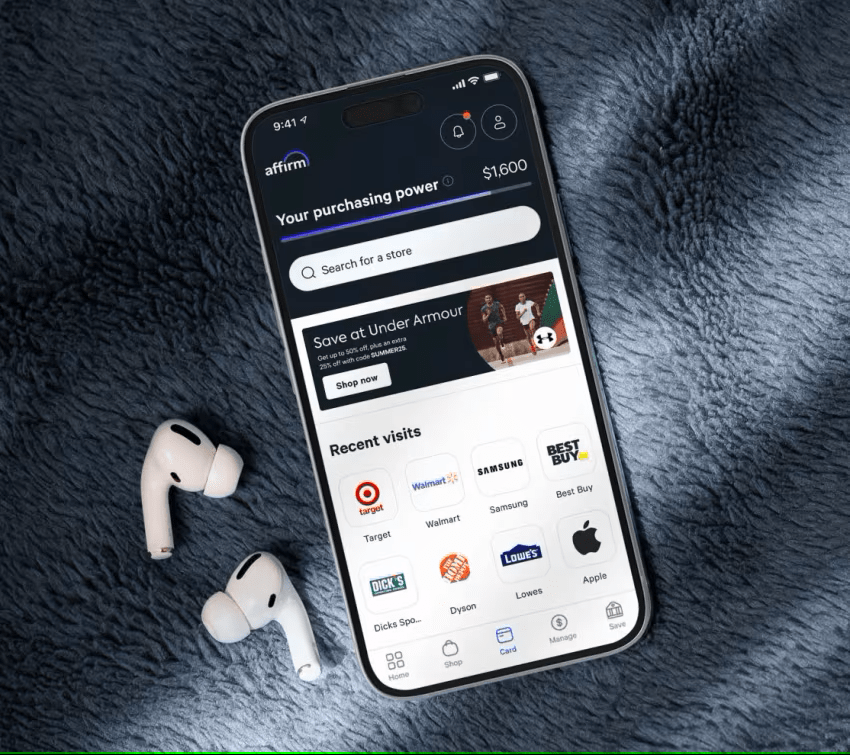

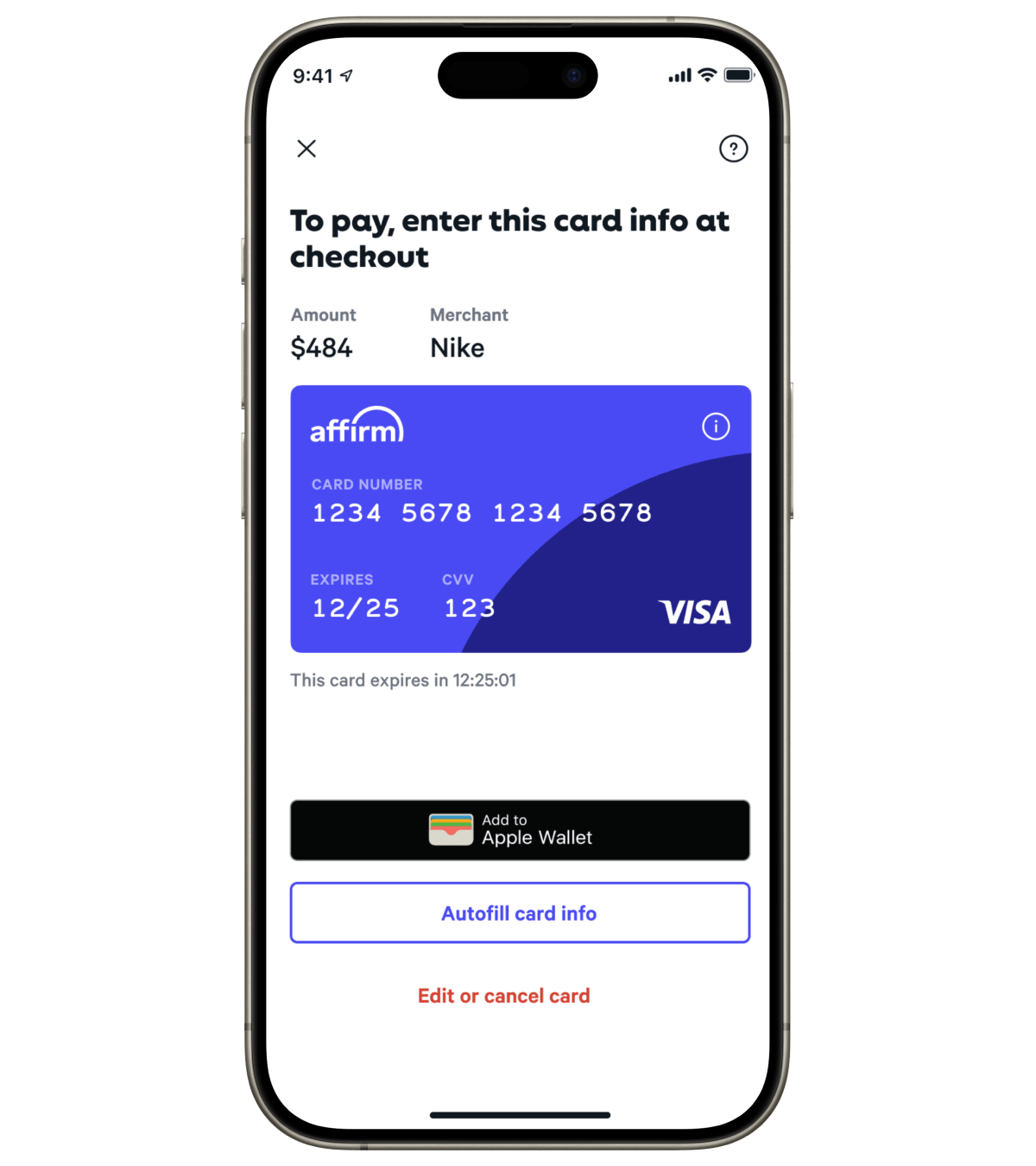

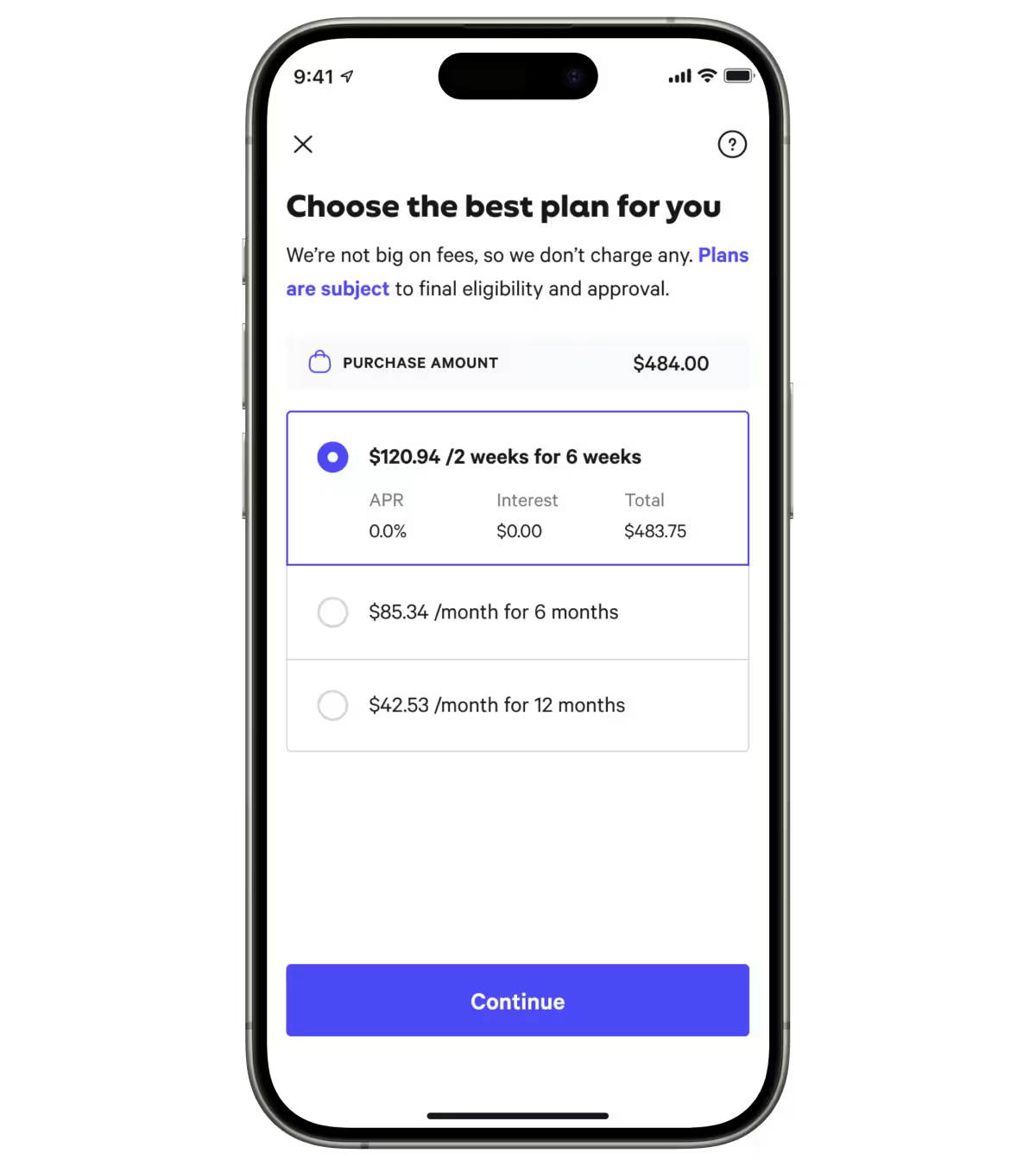

How to pay

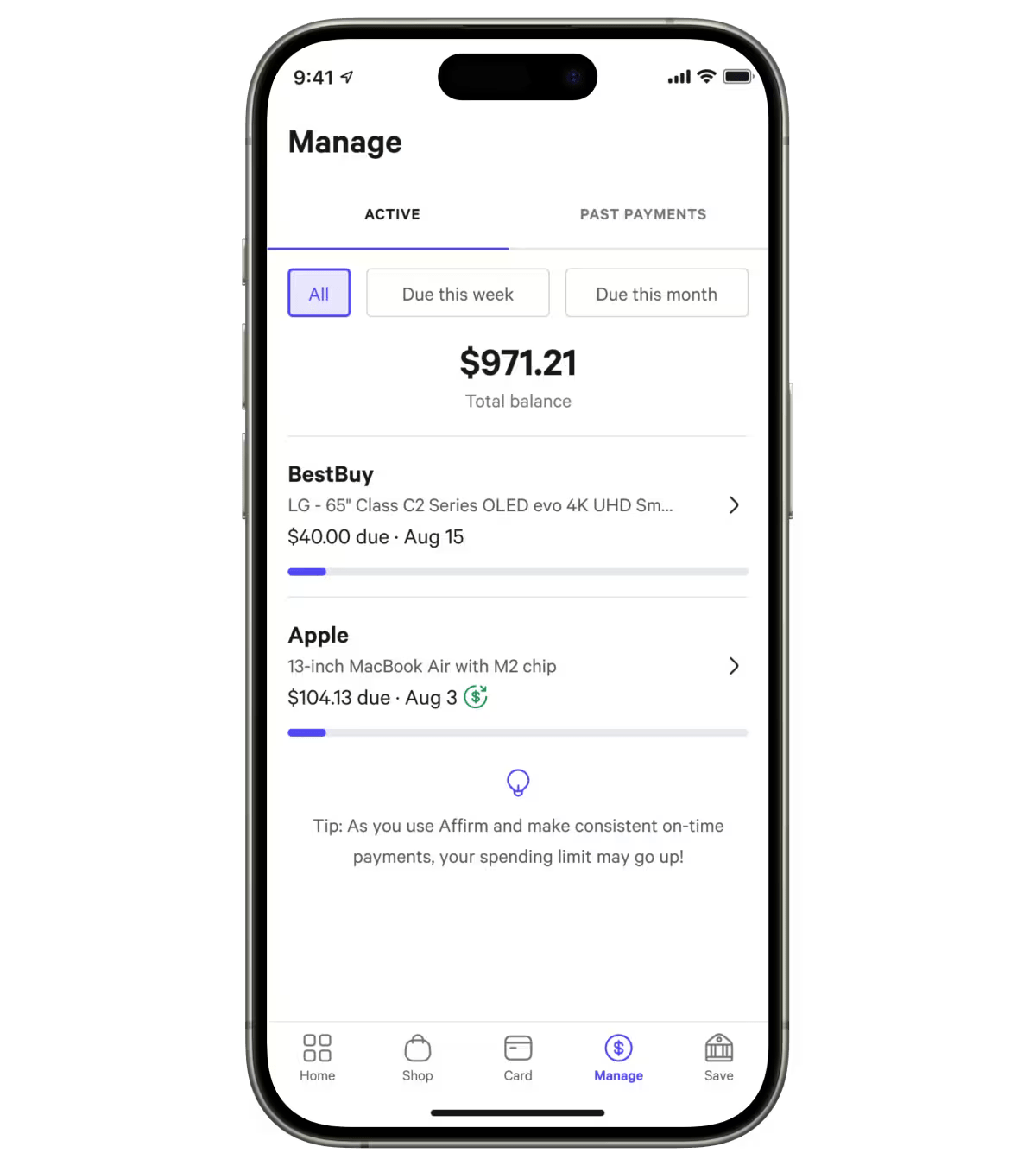

Take Affirm just about everywhere

Take Affirm just about everywhere

You can find Affirm online, in-store, and in your wallet. We make it super simple to pay over time at all your favorite places.